Brush Your Teeth Until Your Gums Bleed: The American Way

Have you ever known how to do something, like really known, and been confident about it only to have someone tell you that what you thought you knew to be true was completely wrong? So wrong that part way through their explanation you realize how wrong you were? Inevitably you let out an “ooooooOOOOOooooooo” sound where the pitch jumps up in the middle.

When I was in 6th grade my family traveled to DC to visit family friends that we had not seen in a while. I’m sure it was a great weekend of reconnecting, swimming in their pool, and reminiscing, but I couldn’t tell you because I barely remember any of that. The only thing I remember was when my mom, Gavin, and I were all in the bathroom brushing our teeth. Gavin was brushing really hard. Like really hard. My mom was concerned and said, “Gavin, why are you brushing so hard”? He responded with confidence, “You’re supposed to brush your teeth until your gums bleed”! My mom responded, “No Gavin, you’re NOT supposed to brush your teeth until your gums bleed”. The look on Gavin’s face, as his pink bloodstained Colgate dripped out of his disbelieving mouth, was unforgettable. And the “ooooooOOOOOooooooo” was immediate.

Consumer Culture

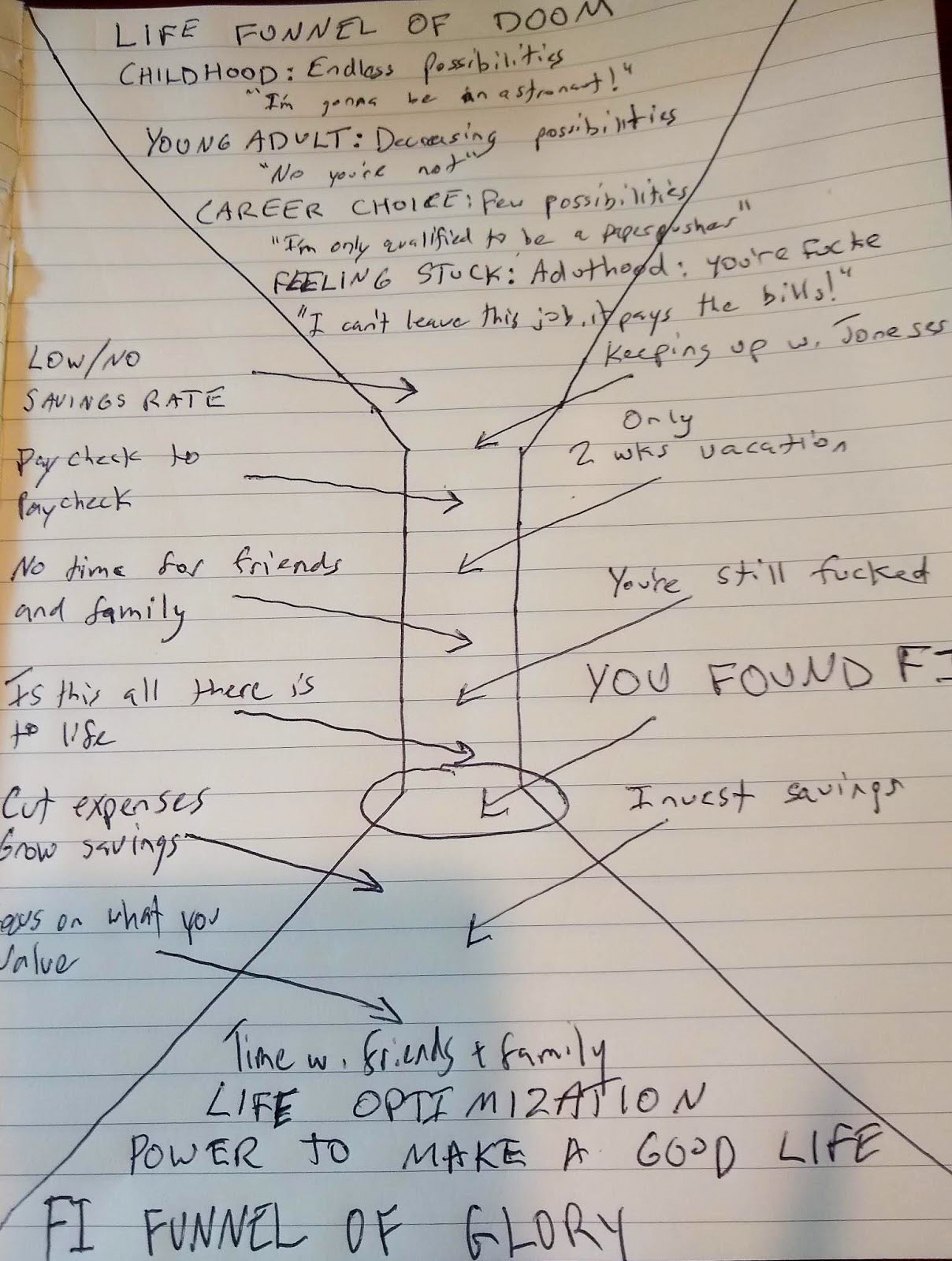

Consumerism is new to humans. Kerryn Higg’s says it best in her article for the MIT press, “Over the course of the 20th century, capitalism preserved its momentum by molding the ordinary person into a consumer with an unquenchable thirst for more stuff.” Buying nicer things is how we signal to the world that we are successful. It’s how we reward ourselves for our hard work, yet it is to the detriment of our future financial selves. Shopping at Amazon and big box stores is how we spend our time and money. We consume content on an ever-growing list of social media platforms to the detriment of our mental and physical health. Believing and operating in this ‘consume more’ lifestyle is like brushing our teeth until our gums bleed.

Somewhere along the line, this is what we were all encouraged to do. Work while you gain weight, lose your health, and spend too little time with your family. Make more money so you can buy all the things you deserve! A bigger house, a nicer car with leather seats, a second house, a nicer car with heated and cooled seats that literally suck the farts off of your butt, a bigger house with a bigger yard and an extra garage, a couple of storage containers to store the extra stuff, oh and a boat! Because clearly, you are giving your family your best that way. But the truth is you’re giving them less than they deserve. Less time, less care, less attention.

And unfortunately, this lifestyle also leads to the inevitability of working until late in life. Consequently, you will have a low savings rate and little to no time to do things you value. If you always want more you will never have enough and you will work endlessly. It’s like an arms race against yourself. Or like choosing to spend your time playing a game of basketball on an ever higher hoop while you desperately work to build your stilts taller.

Stop the Bleeding

When a typical American finds FI it is like the moment when my mom told Gavin that he shouldn’t be brushing his teeth until his gums bleed. I always knew deep down that always consuming more was not the answer. Still, it still struck me how incredible the FI alternative was when it was first presented to me.

While I understood the purpose of FI when I encountered it, at that time I was making so little and had chosen a low-paying career field that I loved so I assumed FI would never be for me. It took a few years before I had the real “ooooooOOOOOooooooo” moment. For some people, the ooOOoo moment comes right away. For others, it will come years later while trapped in a cycle of lifestyle inflation and/or frustration with a job. Many others when presented with this information will stubbornly resist. They will begin to spew excuses for why FI isn’t possible for them. However, they will continue consuming at remarkable levels, pink toothpaste oozing from their mouths with every excuse.

What is this magical FI that I speak of? Financial Independence is deciding to work towards a life that you want to have, not the life that American society is selling you. It is creating space between your spending and your earnings. Which in turn allows you to save money for the future and buys you more freedom. It’s doing something good for you like brushing your teeth lightly with a soft bristle brush and never to the point of bleeding.

Disclaimer: FI is easier to achieve for some than it is for others. There are a million challenges that people are up against like: poverty, substance abuse, caring for sick or disabled family members, racism, sexism, consumer debt, lack of education or low wages. There is no doubt that there are many people who are severely disadvantaged and these disadvantages can slow or even prohibit people from achieving FI and yet, the tenets of FI can help everyone get to a better place in their lives.